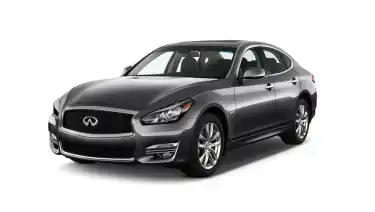

Infiniti Q50 2023 3.0T Luxe Car Loan Calculator in QATAR

To finance this car, you can first calculate the installment price in QATAR

Calculation Of Loans

Total Car PriceQAR 145,000

Down PaymentQAR 29,000

- Monthly PaymentQAR 9,772

- Total CostQAR 146,264

- Loan Period12 Month

Car Loan Monthly Installments Schedule

| Payment Schedule | Monthly Payment | Remaining Amount |

|---|---|---|

| 1 | QAR 9,772 | QAR 107,492 |

| 2 | QAR 9,772 | QAR 97,720 |

| 3 | QAR 9,772 | QAR 87,948 |

| 4 | QAR 9,772 | QAR 78,176 |

| 5 | QAR 9,772 | QAR 68,404 |

| 6 | QAR 9,772 | QAR 58,632 |

| 7 | QAR 9,772 | QAR 48,860 |

| 8 | QAR 9,772 | QAR 39,088 |

| 9 | QAR 9,772 | QAR 29,316 |

| 10 | QAR 9,772 | QAR 19,544 |

| 11 | QAR 9,772 | QAR 9,772 |

| 12 | QAR 9,772 | QAR 0 |

Car Finance Recommendation

Our Partnered Bank

- In-house Team

- Low Interset Rate

- High Approval Rate

Infiniti Q50 2023 3.0T Luxe Car Loan Calculator FAQs in Qatar

- The auto loan process typically involves applying through a bank or financial institution, providing necessary documents such as proof of income, identification, and details of the vehicle. Once approved, you'll receive loan terms and conditions.

- Yes, taking an auto loan can impact your credit score. Timely payments can improve your score, while missed payments can lower it. It's important to manage your payments responsibly.

- Consider interest rates, loan terms, monthly payment amounts, and any additional fees. It's also wise to check your credit score beforehand to understand your eligibility.

- Interest rates for auto loans in Qatar can be competitive compared to other countries, but they can vary based on the lender and the borrower's credit profile. It's advisable to shop around for the best rates.

- You typically need to provide proof of identity, proof of income, residency documents, and details about the vehicle you intend to purchase.

- In Qatar, you can find various loan options from banks, including fixed-rate loans, variable-rate loans, and financing through dealerships. It's important to compare offers from different banks.

- Taking a loan can affect your credit score positively or negatively. Timely payments can improve your score, while missed payments can lower it. It's essential to manage your repayments responsibly.

- You typically need to provide proof of income, identification documents, residency proof, and details of the vehicle you wish to purchase. Some banks may have additional requirements.

- Factors include your credit history, the loan amount, the loan term, and the bank's policies. A higher credit score usually results in a lower interest rate.

- Yes, you can usually pay off your car loan early, but some banks may charge a prepayment penalty. It's best to check the terms of your loan agreement.

Popular Cars in Qatar

Popular Makes in Qatar

Car Offers in Qatar

Jetour Offers in Saudi Arabia: Real Value and Long Warranty… How to Secure the Right Deal?

Dec 31184080

Kia Offers in Saudi Arabia: Flexible Installments and Deals That Reshape Buying Decisions

Dec 2371179

Tank Saudi Arabia Launches End of 2025 Offers with Financing and Maintenance Solutions

Dec 1513670

The Best Mercedes Offers in the UAE: Luxury Options Closer Than Ever to Buyers

Dec 1132640

Infiniti Discounts in Abu Dhabi: Exceptional Offers Reshaping the Luxury Market

Dec 911388